All Categories

Featured

[/image][=video]

[/video]

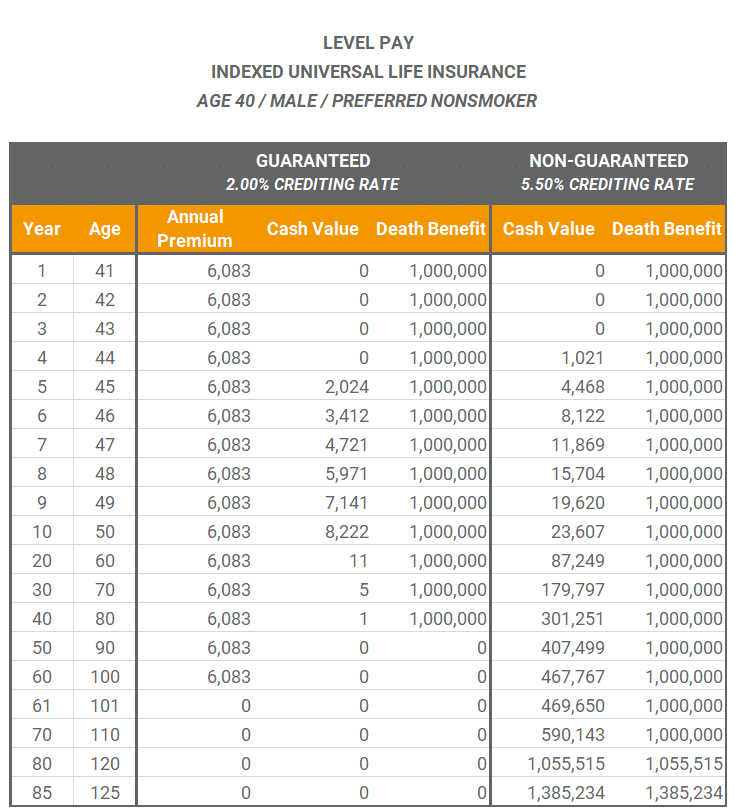

This can lead to much less benefit for the insurance policy holder contrasted to the monetary gain for the insurer and the agent.: The illustrations and assumptions in advertising materials can be deceptive, making the plan seem more eye-catching than it could in fact be.: Be mindful that economic advisors (or Brokers) earn high compensations on IULs, which might affect their referrals to offer you a policy that is not suitable or in your benefit.

Many account choices within IUL items assure one of these restricting aspects while enabling the other to float. The most typical account alternative in IUL plans includes a floating yearly rate of interest cap between 5% and 9% in present market conditions and a guaranteed 100% involvement rate. The rate of interest earned equates to the index return if it is much less than the cap however is topped if the index return goes beyond the cap price.

Various other account choices could consist of a floating involvement price, such as 50%, without cap, indicating the rate of interest attributed would be half the return of the equity index. A spread account credits rate of interest over a drifting "spread rate." If the spread is 6%, the rate of interest attributed would certainly be 15% if the index return is 21% yet 0% if the index return is 5%.

Rate of interest is usually credited on an "annual point-to-point" basis, meaning the gain in the index is calculated from the point the costs got in the account to exactly one year later. All caps and engagement rates are then applied, and the resulting passion is credited to the policy. These rates are changed every year and used as the basis for determining gains for the list below year.

Instead, they make use of choices to pay the passion promised by the IUL agreement. A phone call option is a financial agreement that provides the option buyer the right, however not the responsibility, to get a possession at a specified cost within a particular time period. The insurer purchases from an investment financial institution the right to "purchase the index" if it goes beyond a certain degree, referred to as the "strike price."The carrier could hedge its capped index obligation by acquiring a phone call choice at a 0% gain strike cost and composing a call alternative at an 8% gain strike price.

What Is Iul Insurance

The spending plan that the insurance provider needs to buy choices depends on the yield from its basic account. If the carrier has $1,000 internet costs after deductions and a 3% yield from its general account, it would certainly designate $970.87 to its basic account to expand to $1,000 by year's end, making use of the staying $29.13 to acquire options.

This is a high return expectation, reflecting the undervaluation of options on the market. Both biggest variables affecting drifting cap and engagement rates are the returns on the insurance firm's basic account and market volatility. Service providers' general accounts mostly are composed of fixed-income assets such as bonds and home loans. As returns on these properties have actually decreased, carriers have actually had smaller allocate buying alternatives, causing minimized cap and participation prices.

Providers usually illustrate future efficiency based upon the historical efficiency of the index, using current, non-guaranteed cap and participation prices as a proxy for future performance. This method may not be reasonable, as historical projections frequently show higher past rates of interest and presume constant caps and participation prices despite diverse market problems.

A far better method could be allocating to an uncapped engagement account or a spread account, which involve getting fairly inexpensive alternatives. These techniques, however, are less steady than capped accounts and may need constant adjustments by the provider to mirror market conditions properly. The narrative that IULs are conservative items delivering equity-like returns is no much longer sustainable.

With practical assumptions of options returns and a shrinking budget plan for acquiring alternatives, IULs may offer marginally higher returns than typical ULs however not equity index returns. Prospective purchasers should run pictures at 0.5% over the rate of interest attributed to conventional ULs to assess whether the policy is appropriately funded and efficient in delivering promised performance.

As a relied on partner, we team up with 63 premier insurance provider, ensuring you have accessibility to a diverse series of options. Our solutions are totally free, and our specialist consultants offer impartial advice to help you locate the most effective insurance coverage customized to your demands and budget. Partnering with JRC Insurance Group suggests you receive personalized solution, competitive rates, and satisfaction understanding your economic future remains in qualified hands.

Life Insurance Indexed Universal Life

We assisted thousands of households with their life insurance coverage requires and we can assist you as well. Specialist assessed by: High cliff is a certified life insurance policy agent and one of the proprietors of JRC Insurance coverage Team.

In his leisure he enjoys spending quality time with family members, taking a trip, and the outdoors.

Variable policies are underwritten by National Life and dispersed by Equity Providers, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Policy Business, One National Life Drive, Montpelier, Vermont 05604. Be sure to ask your monetary expert concerning the long-term care insurance coverage policy's features, advantages and costs, and whether the insurance policy is appropriate for you based on your economic circumstance and purposes. Disability earnings insurance typically supplies regular monthly earnings advantages when you are not able to function due to a disabling injury or ailment, as defined in the policy.

Cash value expands in an universal life plan through attributed passion and lowered insurance policy prices. 6 Policy advantages are decreased by any exceptional funding or finance rate of interest and/or withdrawals. Dividends, if any, are influenced by policy fundings and finance passion. Withdrawals over the cost basis may lead to taxable common revenue. If the plan gaps, or is surrendered, any type of impressive loans thought about gain in the plan might undergo average income tax obligations. This adjustment, based on the cap rate(presently 10.5%)and flooring(presently 4%), might declare or negative based upon the S&P 500 price return index performance. Unfavorable market efficiency can produce negative dividend changes which may cause lower general cash money values than would otherwise have accumulatedhad the IPF cyclist not been chosen. The cost of the IPF biker is currently 2 %with an ensured price of 3 %on the IPF portion of the policy. Policy financings against, or withdrawals of, worths assigned to the IPF can negatively affect biker performance. Choice of the IPF may limit the usage of specific dividend options. You need to take into consideration the investment objectives, threats, fees and charges of the investment firm carefully prior to investing. Please call your financial investment expert or call 888-600-4667 for a syllabus, which includes this and other important details. Annuities and variable life insurance issued by The Guardian Insurance Coverage & Annuity Company, Inc.(GIAC ), a Delaware corporation. Are you in the market permanently insurance policy? If so, you might be asking yourself which sort of life insurance policy item is appropriate for you. There are a number of different sorts of life insurance coverage available, each with its own advantages and downsides. Determining which is right for you will rely on a number of aspects, like your life insurance policy objectives, your financial commitmentto paying costs promptly, your timeline for making payments, and much more. This cash money worth can later be taken out or borrowed against *. Significantly, Universal Life Insurance plans supply policyholders with a fatality advantage. This fatality advantage accumulates over time with each costs paid on time. Upon the insurance holder's passing away, this death advantage will be paid out to beneficiaries named in the policy agreement. 1Loans, partial surrenders and withdrawals will minimize both the abandonment value and fatality advantage. Under particular scenarios, plan lendings and withdrawals might undergo earnings tax. This information is precise unless the plan is a customized endowment agreement. 2Agreements/riders may go through extra prices and constraints. Indexed Universal Life Insurance policy is created most importantly to provide life insurance policy protection. Taxpayers need to look for the suggestions of their own tax and lawful consultants regarding any type of tax and lawful concerns applicable to their details situations. This is a general interaction for informational and educational purposes. The products and the information are not designed or planned, to be relevant to anyone's individual scenarios. A repaired indexed universal life insurance policy (FIUL)plan is a life insurance policy product that gives you the chance, when sufficiently moneyed, to join the growth of the market or an index without directly buying the market. At the core, an FIUL is created to offer security for your liked ones in case you pass away, however it can additionally give you a large selection of advantages while you're still living. The key differences in between an FIUL and a term life insurance policy policy is the adaptability and the benefits outside of the fatality advantage. A term plan is life insurance policy that assures settlement of a mentioned survivor benefit throughout a specific duration of time( or term )and a specific costs. Once that term expires, you have the option to either restore it for a brand-new term, end or transform it to a premiuminsurance coverage. An FIUL can be made use of as a safeguard and is not a substitute for a long-lasting healthcare plan. Make certain to consult your monetary expert to see what kind of life insurance and benefits fit your requirements. An advantage that an FIUL supplies is assurance. You can relax ensured that if something occurs to you, your household and enjoyed ones are cared for. You're not revealing your hard-earned cash to a volatile market, producing on your own a tax-deferred property that has built-in security. Historically, our firm was a term supplier and we're dedicated to offering that service however we have actually adapted and re-focused to fit the transforming needs of clients and the requirements of the market. It's a market we've been committed to. We've committed resources to establishing a few of our FIULs, and we have a focused initiative on having the ability to offer strong remedies to clients. FIULs are the fastest expanding sector of the life insurance market. It's a room that's expanding, and we're going to maintain it. On the various other hand, a It supplies tax obligation advantages and typically company matching payments. As you will discover below, these are not replace products and are fit for distinct requirements and purposes. Most everybody requires to develop cost savings for retired life, and the demand forever insurance policy will certainly depend upon your objectives and financial circumstance. Contributions to a 401(k) can be made with either pre or post tax dollars(via Roth if your plan allows). Cash after that can expand taxdeferredup until withdrawal during retirement, or when it comes to Roth contributions, taxfree, revenues and all. Additionally, most employers give a matching contribution that the worker would not or else get unless they get involved in their 401(k)plan.

Latest Posts

Iul Indexed Universal Life

Nationwide New Heights Iul

Iul Fund